The Finance Houses Association announces timely revision of Self-Regulation Code to serve evolving needs

Summary

Introduces Sustainability Mandate as well, to contribute to UN Sustainable Development Goals The Finance Houses Association of Sri Lanka (FHA) the apex body of all Registered Finance companies has announced the introduction of its revised Self-Regulation Code which has been […]

Introduces Sustainability Mandate as well, to contribute to UN Sustainable Development Goals

The Finance Houses Association of Sri Lanka (FHA) the apex body of all Registered Finance companies has announced the introduction of its revised Self-Regulation Code which has been voluntarily practiced by member companies over a long period of time, but has to be adapted to changing times.

The timely revisions to the Code were effected with a view to maintain the highest standards on strategic and business operations in Sri Lanka’s Non-Banking Financial and Leasing Institutions (NBFI) sector.

The FHA collective of 39 Licensed Finance Companies (LFCs) is the driver of financial inclusion of Sri Lanka’s MSME sector which has a large footprint in the Bottom of the Pyramid segment of the country. The MSME sector is no less than the backbone of Sri Lankan economy involving over 70% of businesses in Sri Lanka, providing employment for 45% of the labor force and generating 52% of GDP.

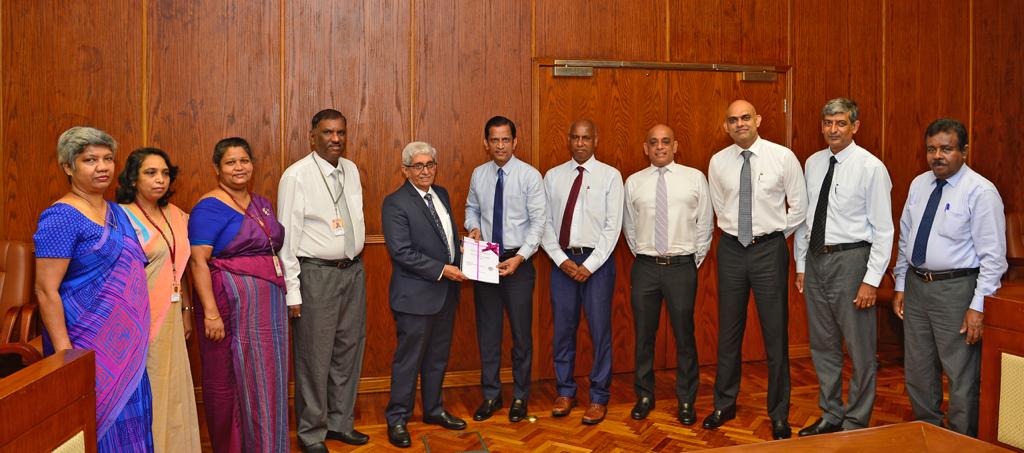

Titled “Code of Conduct of Licensed Finance Companies Sri Lanka” the updated instrument was handed over to the Governor of Central Bank of Sri Lanka Prof. W. D. Lakshman and Bank’s officials by FHA Council members on March 18 at the Central Bank premises.

Niroshan Udage, Chairman of FHA elaborated: “FHA’s time tested gentlemen’s agreement that was codified some time ago needed revisions and updates as per the requirements of today’s changing times. The overall objectives of updating the Code were to comply to all current regulatory and legal requirements while adhering to industry best practices. We take humble pride in the fact that the Code was not imposed on our sector by any authority but was self-introduced by all FHA members on their own will, which demonstrates the members’ strong commitment to sectoral integrity and their social responsibility.”

On 18 March members of FHA also handed over their Sustainability Mandate to the Governor of Central Bank Prof. W. D. Lakshman and top officials of the Bank. “The purpose of the Sustainability Mandate is to serve as the guideline for the LFCs to integrate sustainability principles holistically into their businesses, enabling sustainable value creation through their own financing approaches, in line with defined sustainability guidelines that would ultimately contribute towards national sustainability agenda and UN Sustainable Development Goals” said Chairman Niroshan Udage. “As a growing number of financial institutions in the world are adopting policies, systems, and lending practices that reduce the environmental impact of their operational footprint, it is time Sri Lankan LFCs actively follow suit. We are making sure that financing practices for economic development shall not come at the cost of our ecosystems and our future generations” added Chairman Niroshan Udage.

Romani de Silva, speaking on behalf of the FHA sub committee that overlooks Sustainability – said: “Adopting the United Nation’s Sustainable Development Goals (SDGs) would be significant to every finance company operating in Sri Lanka’s NBFI sector. The good news is that many members of FHA already subscribe to at least three SDG guidelines by default; the SDGs are ‘No Poverty’, ‘Zero Hunger’ and ‘Good Health and Well Being’ through their activities in serving customers at the base of the pyramid. Therefore, Sri Lanka FHA has ‘already arrived’ towards SDGs to some extent. Such facts as our member companies already serving the MSMEs and the Bottom of the Pyramid market and some even investing in Sri Lanka’s Social Enterprises also testifies to FHA members’ active engagement with Sustainability. I further believe that espousing global sustainable value creation initiatives by our member companies would be a viable way to adopt best practices in this regard.”

About the Finance Houses Association of Sri Lanka (FHA):

The FHA is the successor to the pioneering ‘The Ceylon Hire purchase & Finance Association’ formed in 1958, formed to discuss the emerging problems in an unregulated environment of the Sri Lankan finance companies. After several organizational transformations thereafter, ‘The Finance Houses Association of Sri Lanka (FHA) was formed in 1986. In July, 2001, the FHA was incorporated under the Companies Act No. 17 of 1982. Thereafter it was reregistered under 2007 Companies Act. In the course of its history spanning over 6 decades, the FHA has grown in form and stature to discharge a broad range of activities and today it serves as the link between the authorities and the registered finance companies at large.

Photo Caption

From Left: Governor of Central Bank of Sri Lanka Prof. W D Lakshman, Deputy Governor Mrs. T M J Y P Fernando, Assistant Governor Mr.J. P R Karunaratne, Addl. Director / Dept. SNBFI Mrs. R M C H K Jayasinghe, Additional Director / Dept. of SNBFI Mrs. A. P Liyanapatabendi at the handing over event of “Code of Conduct of Licensed Finance Companies Sri Lanka” by FHA Council members at the Central Bank headquarters on 18 March, 2021.